Despite renewed travel restrictions imposed during the lunar new year period, there is every reason to be confident about travel retail 2021 growth prospects in China.

Swiss research agency m1nd-set demonstrates in a special China-focused study on both traffic and shopper insights that, in light of consumer confidence, shopper behavioural changes and the Chinese consumer’s relentless desire to travel, 2021 will mark the beginning of a robust return to growth for the travel retail sector in China.

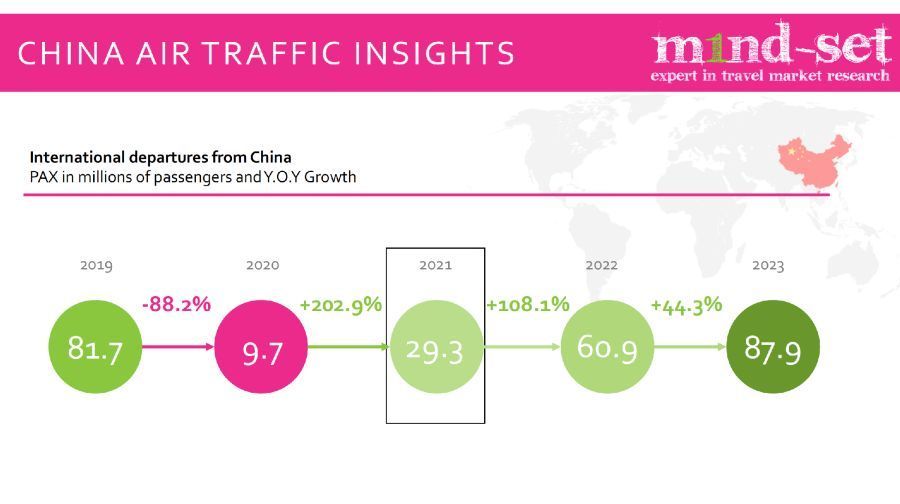

According to m1nd-set’s Business 1ntelligence Service (B1S) traffic and shopper insights data tool, China will see an increase of more than 200% in international departures in 2021, to reach circa 30 million international departures. Pre-Covid levels are expected to return by 2023, when outbound traffic is forecast to reach 88 million following 108% growth in 2022 and 44% in 2023.

The growth forecasts come despite travel restrictions imposed ahead of the Chinese New Year holiday, which saw 28 million Chinese consumers in lockdown following a renewed outbreak of the Covid pandemic in the northern Heilongjiang and Hebei provinces.

m1nd-set’s China market research also details the profile of the Chinese traveller, the impact of the pandemic on their daily life, and in particular the impact on their travel behaviour.

According to m1nd-set, improved testing and containment measures, accompanied by the arrival of the vaccine, the latest outbreak is not expected to generate as significant a blow as when the pandemic first erupted over 12 months ago.

Traveller behavioural trends have changed considerably in China since the outbreak of the pandemic, and Chinese travellers are now paying significantly greater attention to health and safety measures, practicing greater hygiene when travelling, m1nd-set reports.

The impact of the Covid-19 vaccine and how it will affect the Chinese traveller’s desire to travel and their planned shopping behaviour is also analysed in the research.

More than half (53%) of Chinese travellers interviewed said their household income was negatively impacted as a result of the pandemic, moderately lower than the global average of 55%, with a drop of between 5% and 20% compared to pre-Covid levels in China.

In terms of international travel uptake, one third of Chinese travellers said they would travel again not immediately, but within the first 6 months after restrictions are lifted.

The Covid-19 vaccine will inevitably have a highly positive impact in China as 97% of Chinese travellers are willing to receive the vaccine, the majority of whom said they would prefer to get vaccinated as early as possible. The Chinese are more likely to consider travelling again if they have received the vaccine compared to global travellers (39% vs 31%).

When they do eventually travel internationally, the research reveals both positive tendencies and challenges.

Changes at Travel Retail

While 80% of travellers who usually visit the Duty Free store would still do so on future international trips, which is higher than the global average at 73%, two-thirds of Chinese travellers said they will spend less time at the airport compared to before. Around 27% will also spend less time inside shops, and more than half will try to isolate themselves from crowds, more so than the average traveller across all world regions.

m1nd-set Travel Retail Research Director Clara Susset commented: “Communication is key to post-Covid recovery in China. The industry will need to work collectively to restore traveller confidence and entice them back into the stores. It will be essential to provide easy access to clear information about health and safety measures at the airport and potential delays throughout the airport journey due to modified security measures and procedures.”

“Chinese travellers express a clear preference – and a greater tendency than global travellers – for digital technology such as QR Codes, Susset continued, “as a means to learn more about products and brands in the Duty Free shops, search for specific products and check prices before purchasing. The research reveals a number of new such trends and provides recommendations on how to approach this all-important market to ensure the travel retail sector is able to benefit from the Chinese recovery as best possible.”

To purchase the full report, contact: [email protected]