The hotel industry in Africa is experiencing significant growth, with Egypt and the “Big 5” global chains – Accor, Hilton, IHG, Marriott International, and Radisson Hotel Group – at the forefront.

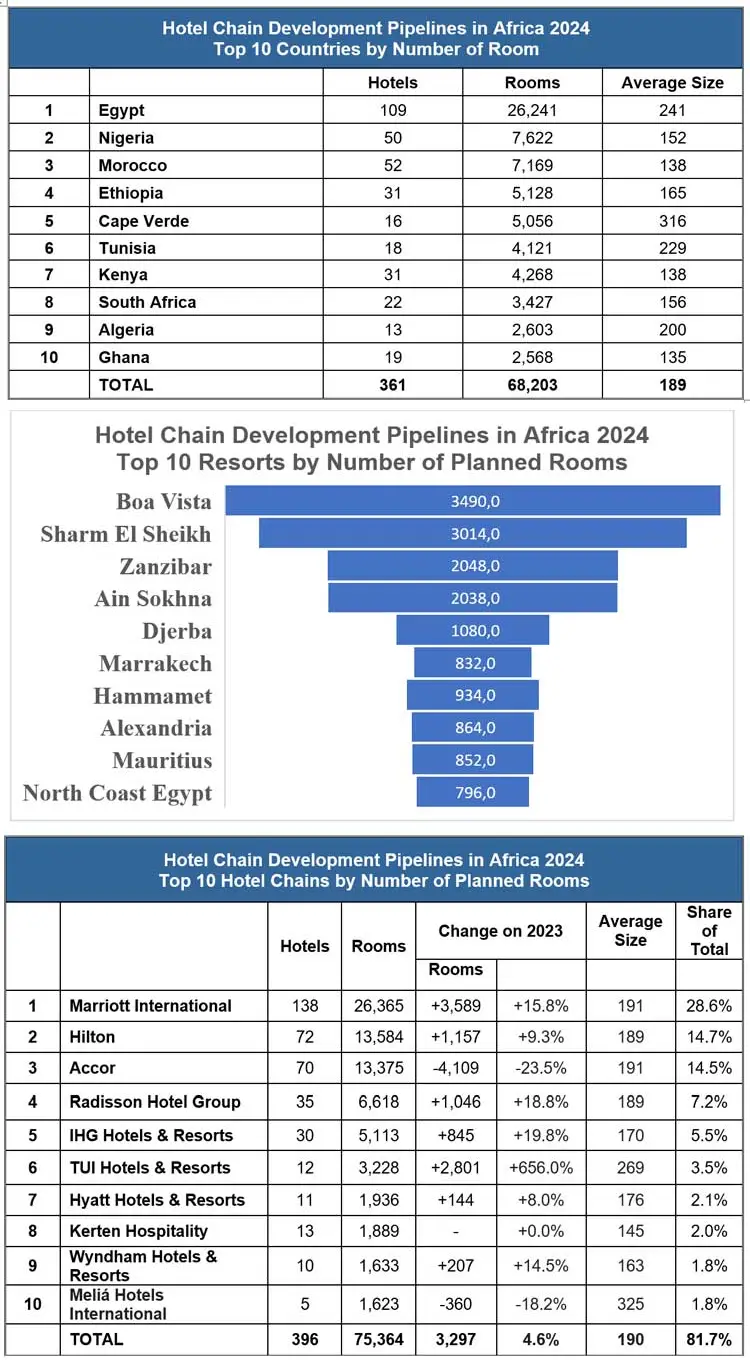

This year’s African Hotel Chain Development Pipeline report, widely acknowledged as the industry’s most authoritative source, documenting and analysing the number of hotels being planned and built across the continent, reports a market share of 28% for Egypt and 71% for the Big 5 global chains.

The survey, conducted by Lagos-based W Hospitality Group, in association with the Africa Hospitality Investment Forum (AHIF), is based on responses from 47 global and regional (African) hotel chains, reporting on a pipeline of hotel development activity totalling around 92,000 rooms in 524 hotels, in 41 of Africa’s 54 countries.

Significant trends to emerge in the past year include strong growth, over 9%, in both North and sub-Saharan Africa, an increase in very large hotels (the average size of the largest 10 hotels is 770 rooms, up from 723 rooms in 2023) and a rapid growth in resorts, up by 32% on 2023.

In this respect, Zanzibar has performed particularly strongly. There, the pipeline has grown from seven resorts with 983 rooms in 2023 to 14 resorts and 2,048 rooms in 2024, a sure sign of confidence in these beautiful Indian Ocean islands.

The extent to which Egypt dominates the African hotel development pipeline each year, with almost 26,250 rooms in 109 hotels, is quite remarkable. The country’s pipeline, up by 19 hotels and about 5,200 rooms in 2023, is larger than the next four countries put together. It has well over three times the number of rooms as second-placed Nigeria, which has 7,622 rooms in 50 hotels.

Third-placed Morocco has 7,169 rooms in 52 hotels and Ethiopia, in fourth place, has 5,128 rooms spread across 31 properties.

There has been an extremely strong increase in the number of resort projects in the pipeline, growing from 24% of the total in 2023 to 30% in 2024.

In addition, around half of the rooms in hotels and resorts that opened last year were in resorts. Both Boa Vista (Cape Verde) and Sharm El Sheikh (Egypt) score highly because of the very large average size of the resorts there.

The largest hotel in the entire pipeline is a Rixos resort being planned in Sharm El Sheikh, with over 1,800 rooms.

The Big 5 global chains – Marriott International, Hilton, Accor, Radisson Hotel Group and IHG Hotels & Resorts – account for 66% of hotels and 71% of rooms in the entire African pipeline.

Marriott International, the world’s largest hotel chain, remains in the lead for the third consecutive year, in a seemingly unassailable position as number one, with almost twice the number of pipeline hotels and rooms as second placed Hilton, and it has the largest number of rooms added in the year.

Looking back at previous years, there used to be a neck and neck race between Accor and Marriott International but, for the second year running, Accor’s pipeline has actually decreased, from a high of about 20,250 rooms in 2022 to 13,375 rooms today. Executives say that they are focused on having a “clean and achievable pipeline, rather than numbers for numbers sake”.

Accor’s quote highlights a key issue in tracking hotel development in Africa, which is differentiating between hotel projects that are proposed from those that are under construction and from those that have been completed.

Typically, the length of time between signing and opening is between four and five years. However, the report identifies 35 projects in the pipeline that are 10 or more years old, including one hotel that was signed 16 years ago.

When it comes to hotels under construction, Marriott International leads the way, with 138 hotels (15,011 rooms) currently being built. It is followed by Hilton (72 hotels, 5,955 rooms), Radisson Hotel Group (35 hotels, 5,748 rooms) and Accor (70 hotels, 3,346 rooms). TUI Hotels & Resorts has charged into the rankings in fifth place with 12 hotels (2,208 rooms) under construction. As well as looking at deals, which may or may not materialise, W Hospitality Group also looked at who was opening hotels in Africa in 2023, and where.

Of the total 29 chain hotels and resorts that opened in Africa in 2023, the split was 10 in North Africa and 19 in sub-Saharan Africa.

Of those 19 openings, 11 were in East Africa, including six new hotels and resorts in Tanzania, which had the most openings of any African country.

It is clear evidence of the attractiveness of both the mainland and Zanzibar to investors and operators.

Accor came out top of the list for openings last year, and it also tops the number of hotels and rooms opened over the past five years (2019-2023), with 34 hotels opening, comprising around 5,500 rooms.

In terms of “actualisation”, 2023 was an exceptionally slow year. However, that is likely to be offset by a strong 2024, during which the top 10 chains expect to open 139 hotels with 19,122 rooms.

The report from W Hospitality Group points to a robust growth in the hotel development pipeline, with an optimistic outlook for 2024. This growth is expected to contribute positively to the continent’s global hotel industry share.

The African Hospitality Investment Forum plays a crucial role in connecting industry leaders and facilitating investment in tourism and hotel development across Africa. This event is pivotal in driving forward the continent’s hospitality sector.