In a city as bustling as Los Angeles, Airbnb hosts are seeing unprecedented profits, even as the city intensifies its crackdown on illegal listings. While advocacy groups point fingers at the platform for exacerbating L.A.’s housing crisis, hosts have discreetly increased their rates, enjoying greater revenue than ever before.

Since the pandemic, host revenues have surged beyond previous benchmarks. In 2022, the average revenue for a host was $17,654, showcasing an impressive increase of over $4,000 from the previous year, according to AllTheRooms, a short-term rental analytics company. The momentum shows no sign of slowing down in 2023.

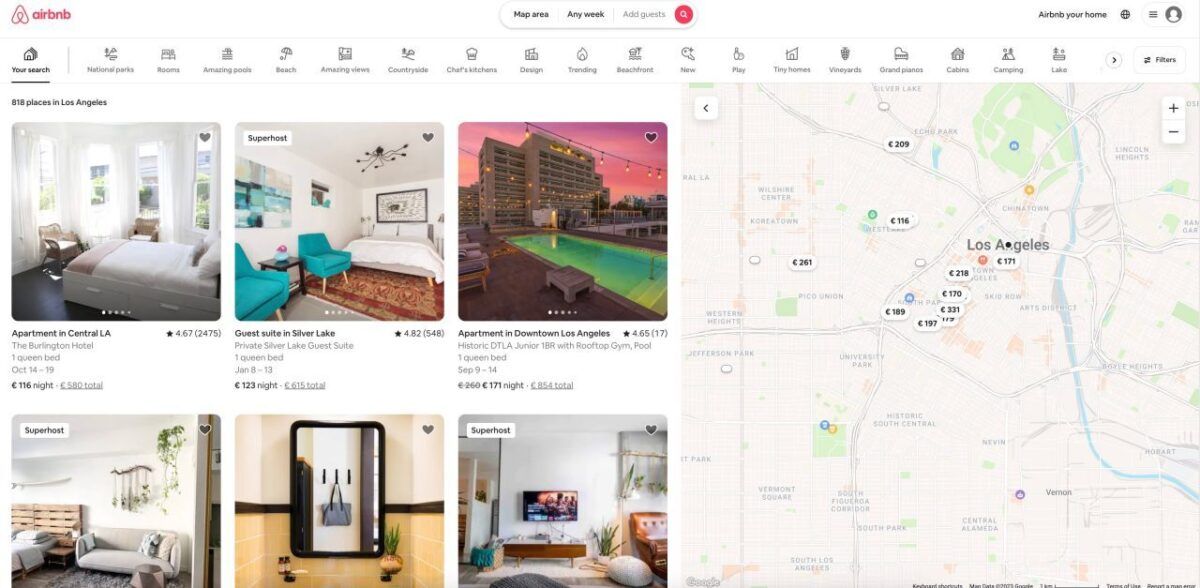

Despite this lucrative trend, listings have plummeted. From 16,973 listings in August 2019, the number has almost halved to 7,360 in the present year. Many attribute this to the city’s Home-Sharing Ordinance that came into effect in 2019. This law restricts residents to only listing their primary residence, where they must reside for at least six months annually, the Los Angeles Times reportsLos Angeles Times reports.

While the ordinance was successful in reducing listings by over 70% across all home-sharing platforms since its inception, numerous illegal listings persist. Reports indicate that a significant proportion of listings may violate the ordinance, with some hosting guests for over half the year.

For many hosts, the profits from Airbnb are indispensable. One anonymous host operating three listings mentioned, “This is my primary source of income… One listing alone wouldn’t cut it.”

Concerns grow as the shortage of housing continues to be a significant issue for the city. Critics argue that the lucrative short-term rental market contributes to the rising rents and the homelessness crisis. Peter Dreier, a professor at Occidental College, noted, “When you take units off the market and rent them to tourists… it leads to more people fighting over fewer units. And that leads to higher rents.”

With Los Angeles collecting $33.88 million in transient occupancy taxes (often referred to as a “bed tax”) during the 2021-22 fiscal year, the city benefits financially from the platform. However, some argue that the city could generate even more revenue by imposing fines on illegal short-term rental listings.

Randy Renick, executive director of Better Neighbors LA, stressed the impact of short-term rentals on communities. His organization maintains a hotline for residents to report unauthorized listings. They push for the city to address these reports and also advocate for measures that would return these homes to the long-term rental market.

Los Angeles hotels, in contrast, have reported fluctuating occupancy rates, indicating a potential shift in traveler preference towards alternative accommodation options like Airbnb.

Santa Monica’s strict enforcement model, which mandates the host to live on the property during the renter’s stay, is cited as a successful example that L.A. could emulate. Frank Tai, a law-abiding host in Playa del Rey, commented on the city’s increased vigilance, “I’m in compliance, but it’s a lot of work… They’re trying to stay on top of things.”

As L.A. navigates this tricky landscape, hosts and regulators are bound to face more challenges and negotiations in the coming days.