Africa hotel development is booming, with Marriott International and Hilton dominating the continent’s rapidly expanding hospitality landscape.

The latest Hotel Development Pipeline Report reveals a record 577 hotels and resorts in the pipeline across Africa, totaling 104,444 rooms. That’s a 13.3% increase over 2024, significantly outpacing the global average growth rate reported by leading international hotel brands.

Compiled by Lagos-based W Hospitality Group using data from 50 international and regional hotel chains, the report highlights a particularly strong surge in North Africa. That region alone recorded a 23% year-on-year increase in pipeline activity, compared to a more modest 6% rise in sub-Saharan Africa. Over the past five years, development in North Africa has grown at an average annual rate of 12%, compared to 4% in sub-Saharan Africa, and 7% overall.

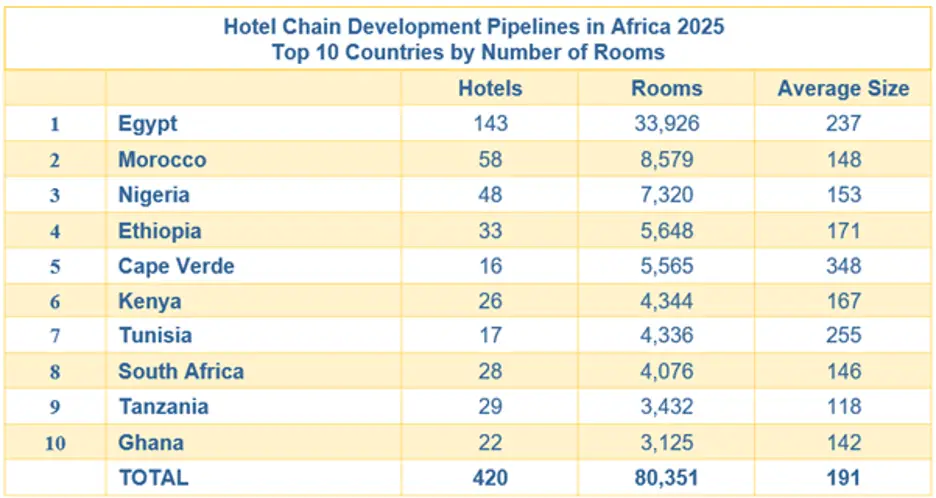

Egypt is by far the frontrunner in the region, with 143 hotels and 33,926 rooms currently in development—nearly four times the number of rooms being built in Morocco, which ranks second with 8,579 rooms in 58 hotels. Other countries leading the pack include Nigeria (7,320 rooms), Ethiopia (5,648), Cape Verde (5,565), Kenya (4,344), Tunisia (4,336), South Africa (4,076), Tanzania (3,432), and Ghana (3,125). International chains now have hotel deals signed in 42 of Africa’s 54 countries.

While Egypt has the largest overall pipeline, fewer than 50% of its planned rooms are currently under construction. Morocco, by contrast, has over 72% of its rooms actively being built. Ethiopia has the highest ratio of rooms “on site,” followed closely by Morocco and Ghana. Some countries, like Nigeria and Cape Verde, have large pipelines but relatively low construction activity, with some hotel projects remaining dormant for years.

Cairo stands out as a hotspot, with a staggering 17,757 rooms planned across more than 70 hotels. The next largest city, Sharm El Sheikh, has a much smaller pipeline of 4,231 rooms in under 10 properties. Other cities and resorts making notable appearances include Lagos (3,709 rooms), Boa Vista (3,650), Addis Ababa (3,369), Casablanca (2,939), Accra (2,652), Abuja (2,570), Zanzibar (2,523), and Dakar (2,334).

Marriott International leads the charge with 165 hotels totaling 29,639 rooms in the pipeline. Hilton follows with 93 hotels and 17,040 rooms. Accor has 73 hotels with 15,013 rooms, IHG comes in with 40 hotels and 7,951 rooms, while Radisson Hotel Group has 32 hotels with 6,346 rooms. Other contributors to Africa’s hotel growth include TUI Hotels & Resorts, Barceló Hotels & Resorts, The Ascott, Kerten Hospitality, and Wyndham Hotels & Resorts.

In terms of recent growth, Hilton added more rooms to its African pipeline last year than Marriott and achieved a higher percentage increase. Barceló Hotels & Resorts recorded the most dramatic growth, more than doubling its pipeline to 2,193 rooms thanks to three major resort signings in North Africa.

Key Trends Reshaping Africa’s Hospitality Sector

Several important trends are emerging from the data. First, the actualisation rate—the ratio of actual hotel openings to expected openings—has nearly doubled, climbing from 21% in 2023 to 38% in 2024. Though still below the 75% seen in 2019, it marks a clear post-pandemic recovery. Over 50,000 rooms in 304 hotels are expected to open in just the next two years, in 2025 and 2026.

Second, resort development is outpacing city and airport hotel projects, both in terms of volume and size. Resorts average 210 rooms per property compared to 170 for city hotels, and nearly half of the rooms that opened last year were in resorts—evidence of Africa’s growing appeal as a leisure destination.

Third, franchise models are gaining popularity across the continent. There are now 108 franchise projects, representing nearly 19% of all developments, up from just under 10% in 2020. This rise is fueled by the emergence of strong white-label operators like Aleph Hospitality and Valor Hospitality, along with reliable local operators in countries like Kenya and Nigeria. Their presence is giving international chains more confidence that brand standards will be upheld.

All eyes will be on Cape Town this June, when the findings of the full report will be discussed at FHS Africa (formerly the Africa Hospitality Investment Forum). The event is expected to gather top decision-makers shaping the future of hospitality on the continent. As Trevor Ward of W Hospitality Group noted, with 125 new hotel deals and 21,000 rooms signed last year alone, the surface of Africa’s hospitality potential is only just being scratched.