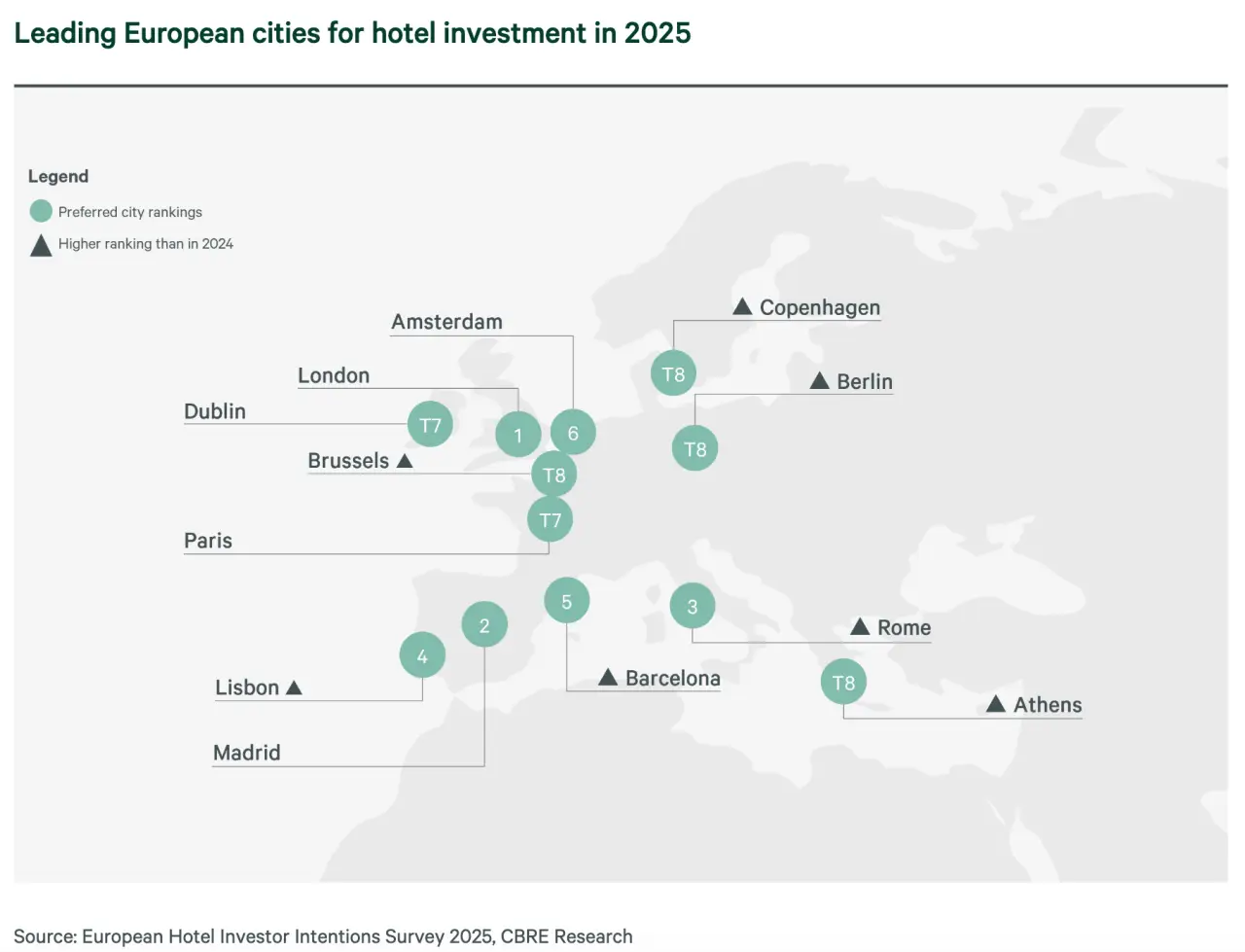

Rome, Lisbon, and Athens are quickly emerging as Europe’s new hotspots for hotel investment, challenging long-established favorites like London and Paris.

As revealed in the 2025 European Hotel Investor Intentions Survey by CBRE, these cities have climbed the investor rankings due to their attractive market fundamentals, increased tourism demand, and a growing luxury hotel segment.

Rome has surged ahead to become the third most preferred city for hotel investors, overtaking Paris. This shift reflects not only the Italian capital’s cultural appeal but also a wave of international-class hotel openings that have enhanced both quality and liquidity in the market. These additions are helping Rome meet the rising expectations of global travelers while drawing investor attention.

Lisbon, the Portuguese capital, continues its impressive rise, securing the fourth spot in the city rankings. With its blend of historic charm, scenic coastline, and growing global connectivity, Lisbon is becoming an increasingly attractive destination for tourists and investors alike. The city’s positive tourism outlook and improving infrastructure are fueling confidence in its hospitality sector.

Athens has also made a notable entry into the top ten most attractive hotel investment destinations. Thanks to Greece’s steady growth in international arrivals and a rapidly expanding luxury segment, the capital has gained traction among investors looking to diversify their portfolios beyond traditional Western European hubs. Athens offers a blend of cultural richness, affordability, and growth potential.

Emerging Destinations Backed by Shifting Travel Trends

The rise of these cities isn’t happening in isolation. Investor sentiment is responding to broader trends in travel behavior, infrastructure development, and post-pandemic tourism recovery. Secondary markets and underexplored capitals are now capturing more attention as travelers seek authentic, less crowded experiences. For hotel investors, this shift translates into new opportunities—especially when coupled with improving air access and local investment incentives.

According to CBRE’s findings, the attractiveness of these emerging hotspots is also supported by a broader move toward value-add strategies. Investors are looking beyond turnkey acquisitions, focusing instead on rebranding, refurbishment, and repositioning properties to meet rising consumer expectations. This trend is especially visible in cities like Athens and Lisbon, where boutique and lifestyle hotels are booming.

Meanwhile, established gateway cities like London and Madrid continue to lead in total investment volume, but the real story of 2025 is the geographical broadening of interest. More investors are venturing into new territories, recognizing that Europe’s hospitality landscape is evolving.

This evolution aligns closely with the growing appeal of high-end segments. In fact, investors drawn to cities like Rome, Lisbon, and Athens are often those with a strong interest in luxury and upper-upscale hotels, which remain the most attractive segments across the continent.

While Rome benefits from brand expansion and tourism recovery, Lisbon is powered by lifestyle-driven hospitality growth. Athens, once overlooked, is now stepping into the spotlight with a range of development projects aimed at the upper tier of the market. The common thread is clear: these cities offer a blend of cultural depth, rising demand, and room for growth—making them ripe for investment in the years ahead.

As we look to the future, Rome, Lisbon, and Athens are poised to become key players in Europe’s evolving tourism economy. For hotel investors, these cities represent the next wave of opportunity—where strong fundamentals meet new traveler preferences in an increasingly dynamic hospitality market.