Business travel has re-emerged with a vengeance. Changes in remote work policies, the increased use of AI and digital transformative technology, geo-political conflicts, environmental change, and the intertwining of travel and meetings are all contributing factors to an increase in business travel.

Not surprisingly, Asia Pacific (APAC) continues to expand as one of the world’s most dynamic and competitive markets for global trade and travel, according to BCD’s Cities & Trends 2025 Asia Pacific edition, which shows the top destinations for APAC business travelers with insights into how they travel. The findings are based on BCD clients’ flight data from 2024 in a range of APAC markets.

According to the Global Business Travel Association’s (GBTA) first Business Travel Outlook Poll of 2025 , APAC led global business travel spend growth last year, with more than three in four (78%) buyers from that region reporting a higher volume of trips compared to 2023 – including 30% who saw a significant increase.

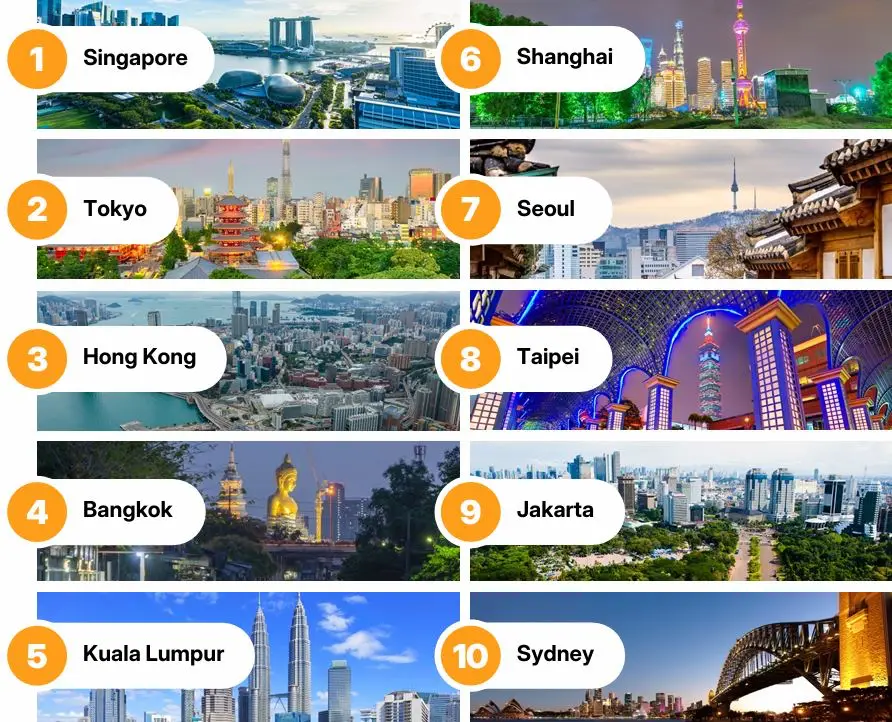

Top 10 APAC cities

Singapore’s strategic location and vibrant economy plays no small part in the city-state’s popularity among business travellers. It remains unchallenged in the top spot in BCD’s top 10 APAC cities, with a 20% increase over 2023.

Attractive reforms such as low corporate taxes , visa free policies, superior connectivity and an overall pro-business infrastructure are a win-win for both business travellers and those attending meetings and events in Singapore.

Tokyo moved up to take the second spot in 2024 with a 38% increase, followed by Hong Kong and Bangkok. 2 3 Singapore Tokyo Hong Kong 6 7 8 Shanghai Seoul Taipei Kuala Lumpur, Shanghai, Seoul, Taipei and Jakarta remained unchanged in their positions in 2024, but welcomed the addition of Sydney into the No. 10 spot.

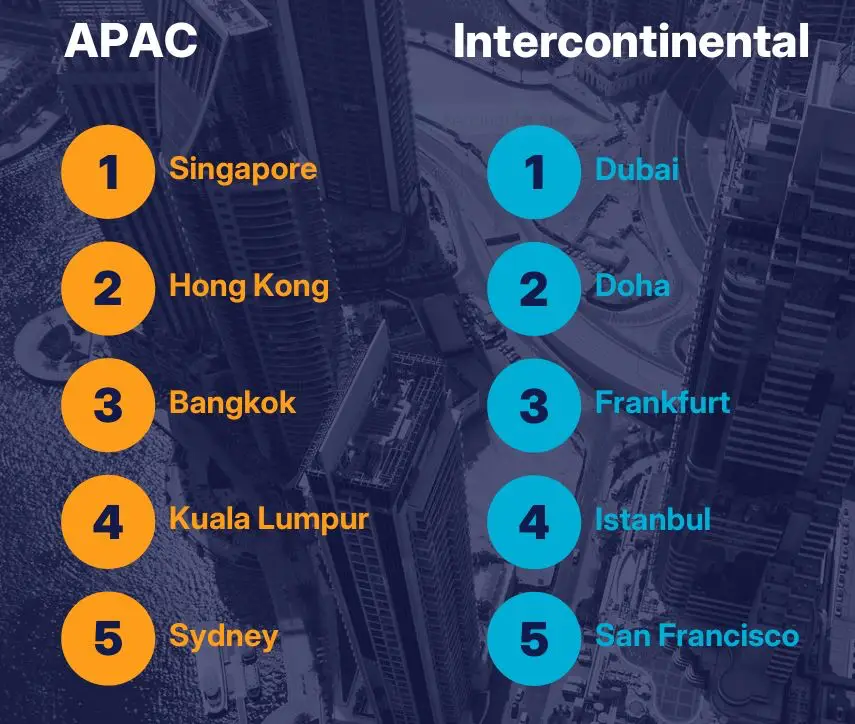

Top 10 intercontinental cities

The list of intercontinental cities is split between five cities in Europe and five in North America, and led by Frankfurt, London and San Francisco. San Francisco and New York City are both in the top five in 2024.

Top 5 countries in terms of flight transactions

According to BCD flight transactions, Singapore once again was the most visited APAC country. Reciprocal visa free policies with other countries in Southeast Asia, an increase in flight seat capacity throughout the region, and an overall reduction in flight fares has contributed to Singapore’s steady growth.

China and Japan closely follow Singapore’s lead. Hong Kong notably dropped off, but Malaysia entered into the top five. Overall, APAC has already outpaced its 2019 total seat capacity by 0.5% in 2024, signalling strong recovery in the post Covid-era across both domestic and international routes, and flourishing as the world’s second-largest market for international travel.

The top five intercontinental countries remained the same from 2023 to 2024, with the U.S. leading the way.

Top 10 flight routes

According to BCD flight data, the most frequently travelled routes for APAC flights primarily depart from Singapore, which accounts for five positions in the top 10 city pairs. Singapore Airlines and Cathay Pacific are among the leaders in international seat capacity across the region.

Notably, Singapore Airlines has surpassed its 2019 capacity by 14.1%, placing itself in the top 10 Asia-Pacific carriers achieving significant growth beyond pre-pandemic levels .

Interestingly, in intercontinental routes Shanghai San Francisco placed as No.10, moving up from its position as No.17 in 2023. Notably, three of the top 10 intercontinental routes originate from Bengaluru (to Frankfurt, London and Seattle).

In April 2024, India’s international airline capacity reached 7.3 million seats, reportedly an increase of 17% from the 6.2 million seats scheduled in April 2019 . This, coupled with rising passenger demand, fleet upgrades and government initiatives to increase its influence as a major aviation hub, has catapulted India as a powerhouse market.

For intercontinental city pairs, Bengaluru to Frankfurt tops the chart.

Top 5 connecting segments, direct flights and layover cities

Direct routes are often the most sought-after due to convenience and comfort factors. Travellers increasingly demand value from in-flight service, and many seek premium travel options. Most APAC flights are direct (89%), largely due to the well-connected route networks within countries.

In contrast, only 25% of intercontinental travel from APAC is direct. This could be due to flight times, high costs or the lack of direct flights. APAC saw a minimal increase in connecting flights in 2024 from 2023, whereas intercontinental routes saw roughly a 5% decrease in connecting segments in 2024 from 2023.

The top three layover cities in APAC are Singapore, Hong Kong and Bangkok. The top three intercontinental layovers are Dubai, Doha and Frankfurt. No doubt, all these bustling aviation hubs provide unparalleled airport facilities, shorter layovers, and convenient regional and international flight networks to business travellers worldwide.

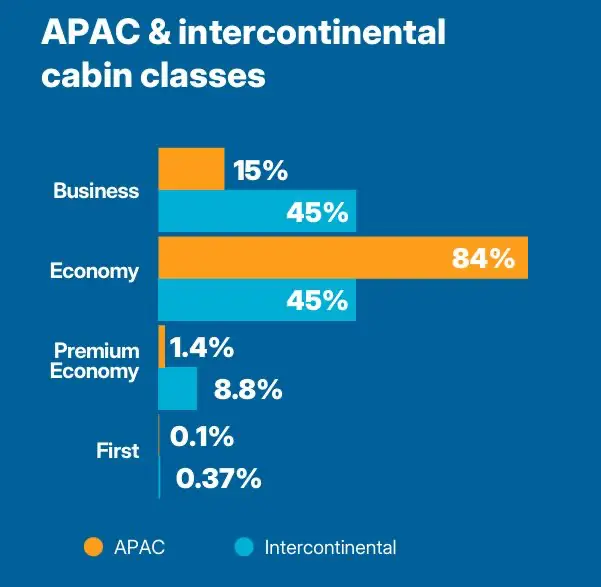

Cabin class

For APAC flights, most travelers (84%) booked economy and roughly only 15% booked business class. For intercontinental flights, the figures are split down the middle, with 45% booking business class and 45% booking economy.

Premium economy seats in APAC remained steady at roughly 1.4% while first class increased slightly to 0.10%. Intercontinental premium economy seats rose slightly to roughly 8.8% while first class decreased to 0.37%.

Conclusion

Business travel to the APAC region will continue to intensify. According to the GBTA , APAC travel buyers reflect the most optimism with 63% indicating they are planning to spend “more” or “a lot more” in 2025, followed by North American travel buyers at 57%.

Demand is further fuelled by leisure + business travel, the re-opening of China, the return of large-scale events such as conferences and face-to-face meetings and increasing airline and hotel capacity.