Choosing the right rewards credit card that fits your needs can be quite challenging due to the vast options available. It is essential to evaluate every non-cobranded consumer card’s rewards earning and redemption policies, eligibility requirements, and expected rewards value to make an informed decision.

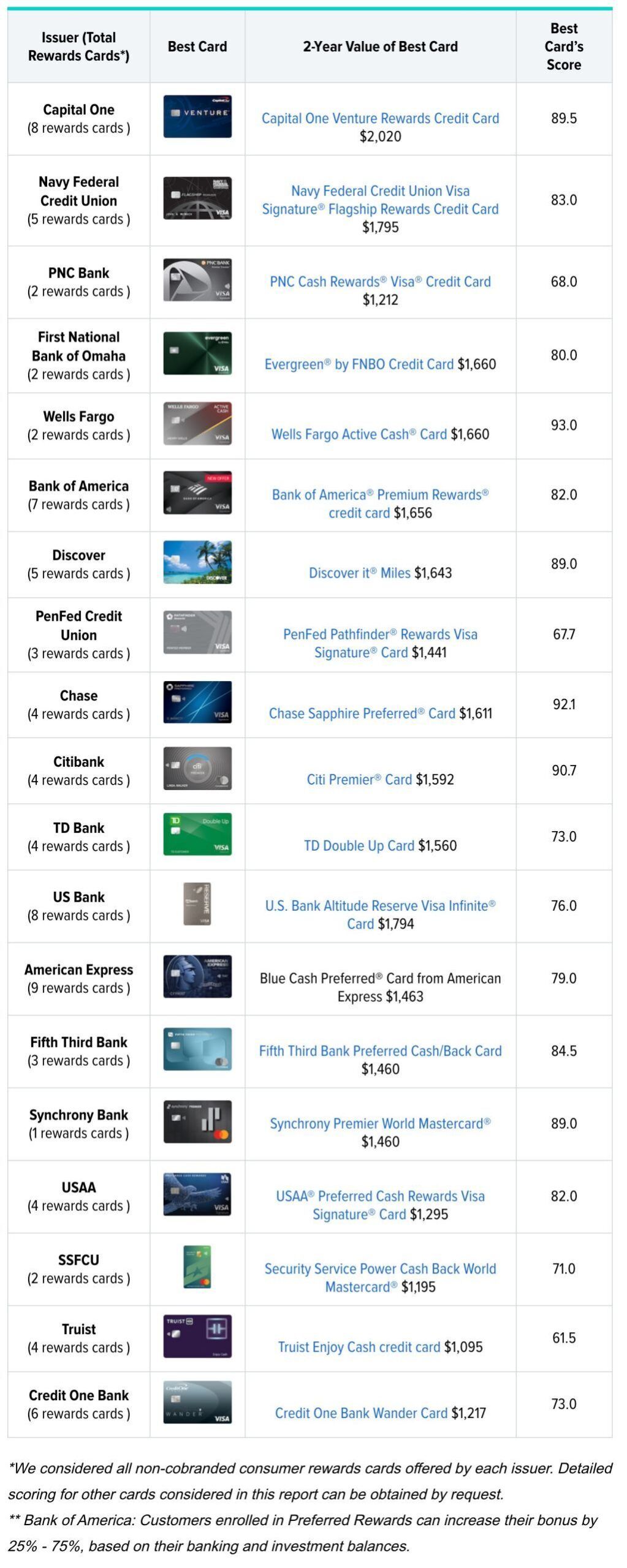

WalletHub evaluated 83 offers from 19 largest issuers, including tips to guide in the selection process. The evaluation process included card’s eligibility requirements, rewards earning and redemption policies, and expected rewards value.

Best Overall: Capital One has the best credit card travel rewards program for the seventh year in a row, earning an average WalletHub score of 92%.

Earning Potential: The best rewards credit card can yield up to $925 more than the worst rewards card over the first two years.

Strategic Redemption: Redeeming credit card rewards for travel is the best deal, yielding 9% more value than merchandise, the worst option.

Earning Policies: Capital One and Wells Fargo have the best rewards-earning policies, with no earning limits and no loss of rewards if you miss a payment.

Redemption Policies: Credit card companies seem content to continue using redemption restrictions to limit the cost of rewards programs. None scored above 80% for their redemption policies.

Eligibility & Transparency: Discover, PNC Bank, Navy Federal Credit Union and Synchrony set the clearest expectations by stating rewards terms and restrictions up front.

Guidelines To Consider When Selecting A Credit Card That Offers Rewards

Not all credit cards with rewards suit everybody, the same way rewards programs vary across credit cards. However, these guidelines will aid in finding the ideal credit card, which is suitable for your finances.

Read Reviews

It is crucial to read reviews about the credit card rewards program you are considering. Your expectations and beliefs concerning the program may be correct or completely incorrect. Therefore, conducting research to uncover the truth, particularly the current happenings and details, since the policies of rewards programs are frequently updated, is essential. By reading customer feedback, you can be better informed about any concealed terms or restrictions, the quality of customer service provided, and more.

Check Your Credit Score

To be eligible for a credit card that offers rewards, a majority of rewards programs necessitate having a good credit score, or in some cases, an outstanding one. In fact, some rewards programs mandate an excellent credit score.

Decide How to Use It

To choose the right credit card rewards program, you must first determine how you plan to use it. Will it be for your everyday spending, or only for specific types of purchases such as travel expenses? By answering such questions, you can narrow down your options by specific card types and terms.

For instance, certain rewards card programs offer a consistent earning rate for all spending categories. Other programs may provide a higher value for specific purchases or with certain redemption methods. By understanding precisely what you require from your rewards card, it becomes easier to decide if a particular credit card offers the features and terms that best suit your needs.

Understanding Earning and Redemption Value

When choosing a rewards credit card, it’s crucial to consider both the earning and redemption value. However, it is hard to evaluate a card if you’re unaware of the value of its rewards. This issue is evident in cashback credit cards, but it can be more challenging to analyze the value of miles and points rewards cards.

The most straightforward approach to determine the value of a credit card’s miles or points is to compare the number needed to purchase a specific item like a flight with the cost of buying the item outright. Suppose you need 40,000 miles to buy a $400 flight, in that case, each mile is worth one cent. By knowing the value of a card’s rewards, you can compare it with other credit cards and make an informed choice.

Avoid the Hassles of Rotating Bonus Rewards

To avoid unnecessary hassle with your credit card rewards, steer clear of cards with rotating bonus rewards categories. These types of cards require you to sign up for new bonus categories each quarter. If you forget to do so, you’ll end up earning nothing more than the market average for that quarter.

This requirement can create an extra layer of complexity in keeping track of your card’s usage. Therefore, if forgetfulness is a concern for you, it’s better to avoid these cards altogether. Instead, go for more straightforward options that offer consistent earning rates across all categories. This way, you can avoid the frustration of keeping tabs on various rotating categories and earn rewards without any extra effort.

Think Smart with Cash Back

When in doubt, it’s always wise to consider using cash back credit cards. Unlike points and miles cards, you will never have to worry about rewards devaluation or calculating reward values with cash back rewards. You will earn your reward in terms of dollars and cents, making it clear precisely how much you’re earning with each purchase.

With points and miles rewards cards, it’s challenging to determine the value of the rewards earned. This ambiguity occurs partly because credit card executives can adjust the number of points or miles required for a reward, like a free flight or a hotel stay, as they wish.

By choosing a cashback credit card, you will enjoy a less complicated earning process, devoid of any confusion about your rewards’ worth. It makes perfect sense to opt for the straightforward approach to earning cashback rewards while avoiding the headaches of evaluating points and miles.

Consider Annual Fees for Credit Cards: Make a Calculated Decision

It’s typical to dismiss cards that come with annual fees, but it’s essential to keep in mind that these cards often offer better sign-up bonuses and higher earning rates than free credit cards. Before you rule out a card simply because it has an annual fee, assess whether the added benefits are worth more than the fees you’re paying.

It’s crucial to do the math and factor in both the extra rewards you’ll earn and the fixed costs of the annual fee. If the rewards outweigh the annual fee, then it may be worth investing in a card with an annual fee.

Therefore, don’t discount these cards without analyzing their potential benefits carefully. By making a calculated decision by assessing your spending habits, you can choose credit cards that offer rewards that best align with your lifestyle while making the most of the added incentives that come with being a cardholder.

For more details, check out the complete list of WalletHub’s best rewards credit cards of 2023.