Luxury and upper-upscale hotels are leading the way in Europe’s hotel investment scene for 2025, according to the latest 2025 European Hotel Investor Intentions Survey by CBRE.

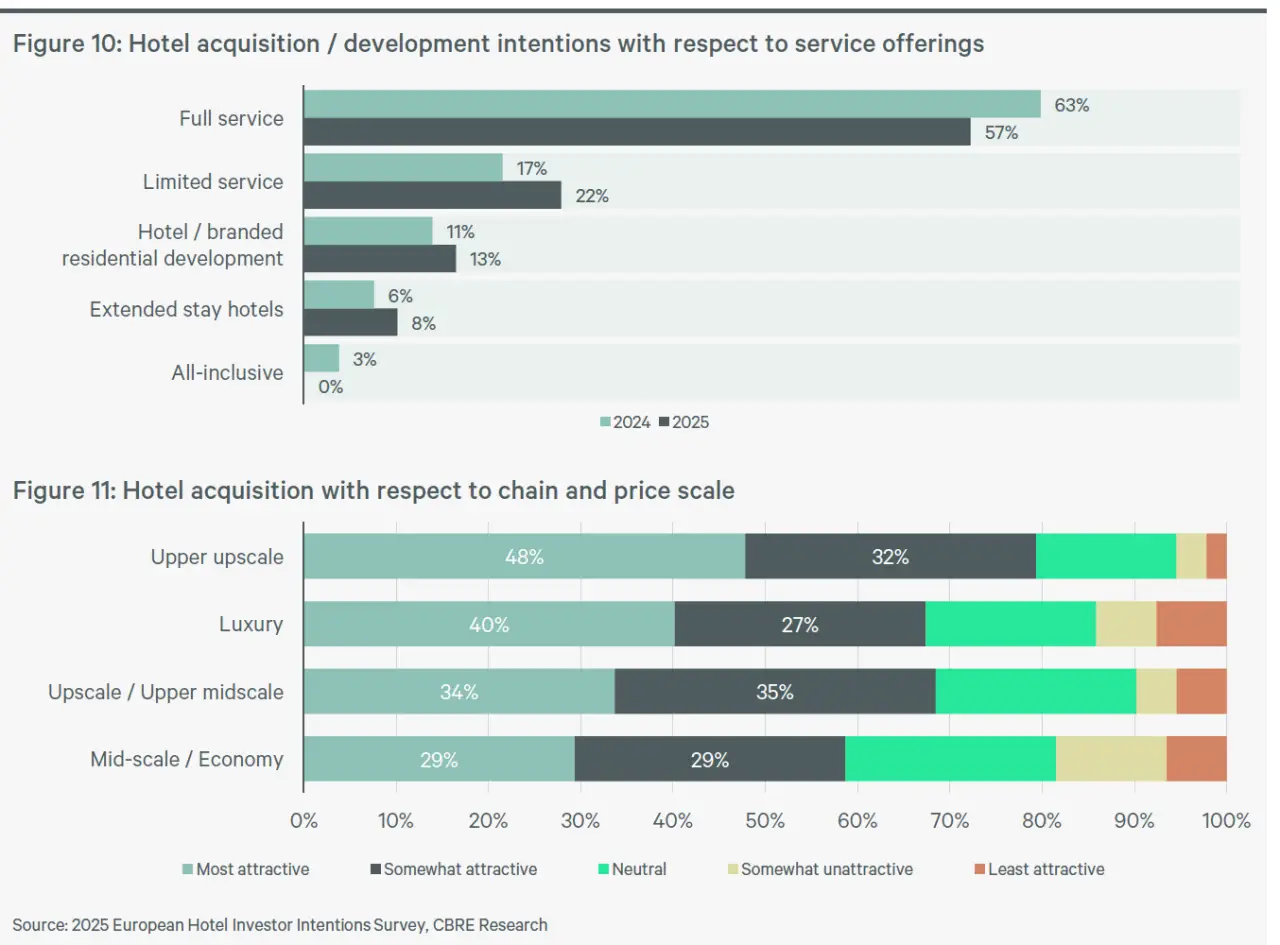

These high-end segments have emerged as the top investment priorities, driven by resilient performance, strong traveler demand, and attractive long-term returns. Among survey respondents, 48% identified upper-upscale hotels as the most attractive, while 40% favored luxury hotels.

The appeal of these categories lies in their proven ability to recover quickly post-pandemic and maintain pricing power even during inflationary periods. High-net-worth travelers are returning in full force, seeking exclusive, high-quality experiences. Investors are following that demand—choosing hotels that offer more than just a bed for the night, but rather a memorable, often immersive stay.

This investor confidence isn’t just about traveler preferences. It’s also about the economics. Luxury and upper-upscale hotels typically enjoy higher profit margins, brand cachet, and long-term capital appreciation. With many of these properties located in Europe’s most visited cities and resort destinations, they offer a strong mix of operational performance and asset appreciation.

Full-Service Remains King, But Limited-Service Is Rising

Full-service hotels remain the dominant preference among investors, with 57% citing them as their top choice, although this figure is down slightly from 63% in 2024. At the same time, limited-service hotels are gaining traction due to their leaner cost structures and consistent demand, particularly in urban and airport locations. Investors are increasingly recognizing the balance these assets provide between efficiency and performance.

Another surprising insight from the CBRE report is the relatively low investor interest in all-inclusive models, despite their popularity among travelers in southern Europe and beach destinations. Extended-stay hotels, on the other hand, are slowly gaining attention, particularly in urban business hubs.

The trend toward luxury and upper-upscale is also closely linked to investor preference for value-add strategies. These strategies often involve repositioning, renovating, or rebranding existing properties to unlock their potential. Independent hotels and those with flexible branding arrangements are especially attractive, offering the ability to upgrade amenities and introduce premium services that cater to the luxury segment.

Survey results also show that investors are now less concerned about price discounts and more focused on long-term value. More than half of the respondents are willing to pay full asking prices—or even above—for the right hotel asset. That kind of bullish sentiment is rarely seen outside of robust sectors like tech or logistics, underscoring the unique position of luxury hospitality in today’s market.

The geographic distribution of interest also aligns with this trend. Cities and regions known for high-end tourism are among the most attractive destinations. Spain, Italy, Portugal, and France are all countries where luxury hotel development and acquisitions are booming. These are also home to Europe’s new hotspots for hotel investment, where luxury travel is not just surviving—it’s thriving.

Rome, for example, is experiencing a new wave of international hotel openings that cater to the premium market. Lisbon is seeing growth in lifestyle and boutique luxury brands, while Athens is capturing investor interest through its expanding upscale segment and relatively untapped potential. All three cities are proving that luxury doesn’t just belong to the usual suspects like Paris and London anymore.

With tourism trends shifting and traveler expectations rising, investors are doubling down on properties that can deliver on both experience and returns. Luxury and upper-upscale hotels are doing just that—positioning themselves as the most resilient and rewarding choices for 2025 and beyond.