While the unprecedented COVID-19 outbreak might have caused significant disruptions, the medical tourism market is set to grow at 12% CAGR in 2021.

While healthcare efforts remained focused on managing the COVID-19 crisis, reversing growth projections to an extent for 2020, with the situation stabilizing, treatment of life-threatening diseases and chronic ailments will begin gaining traction 2021 onwards.

Between 2020 and 2030, the market is forecast to exhibit 12.3% CAGR, as the number of medical tourists is expected to rise at 11% over the same period, according to a new study by an ESOMAR-certified market research and consulting firm.

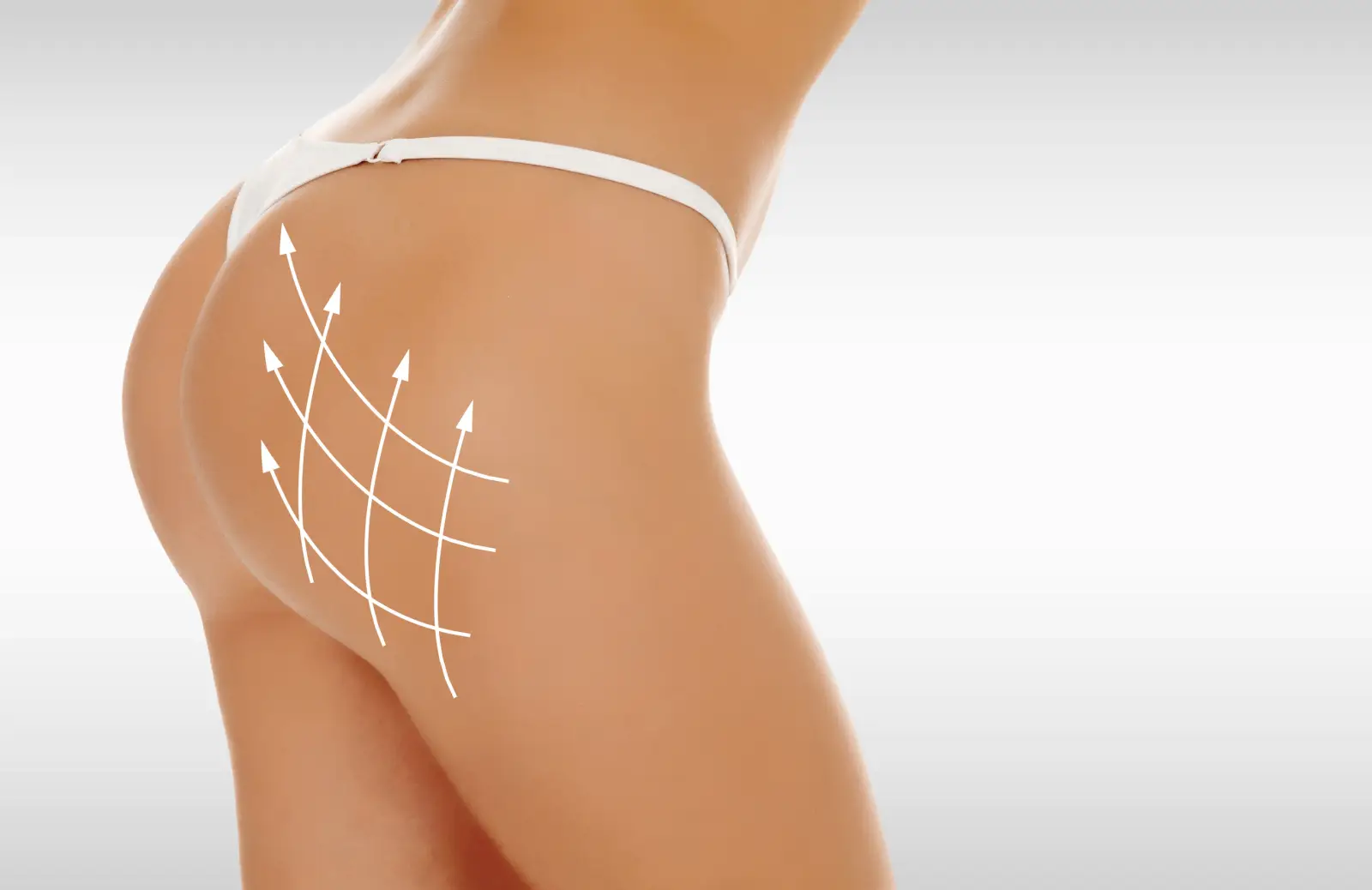

Factors such as increasing healthcare costs in the West, increasing incidence of chronic ailments, and surging demand for various cosmetic procedures have been resulting in the soaring medical tourism.

Availability of cheaper treatment options abroad without compromising on the overall standard and quality of healthcare services is the chief driver of medical tourism in the East. The field contributes significantly to the generation of revenue across developing economies, which has been motivating government aids.

Besides this various government and non-government machineries are contributing towards campaigns to encourage medical tourism. Their efforts are indicative of opportunities existing in the field. For instance, the Tourism Authority of Thailand has launched a very effective e-campaign a couple of years back to assert the country’s position in the global medical tourism landscape. Besides this, various campaigns are launched in India to promote yoga and spiritual centers within the country.

Key Takeaways:

- The U.S. is expected to lead in terms of healthcare travel spending, however, in the coming years China’s spending is forecast to surge considerably

- Among services offered under medical tourism, therapeutic services are highly sought-after. Wellness services too are gaining traction as an increasing number of medical tourists are seeking meditation and wellness retreats

- Phone and online booking will remain more preferred modes of booking for medical tourism

- Medical tourism is often sought for cancer and cardiovascular treatment. Besides this, cosmetics and bariatric procedures are very popular among medical tourists

“Medical tourism will consistently rise thanks to government aids and launch of various e-campaigns by government and non-government organizations, alike. Efforts taken towards expansion of the healthcare infrastructure will therefore present conducive environment for medical tourism market growth,” said a lead analyst.

Medical Tourism Shows Resilience amid COVID-19

While the unprecedented COVID-19 outbreak might have caused significant disruptions, recovery is on card, thanks to prompt response by governments around the world. Thailand’s response to the ongoing pandemic, for instance, has won praise from the United Nations, the World Health Organization, and other experts around the world. Thailand has been ranked among the top five countries among 184 in terms of the effectiveness of their battle against the virus.

According to the Thailand Board of Investment, more than 50 applications for investments, worth over US$ 400 million were submitted during the first half of 2020 to introduce a range of novel measures, accelerating investment in the medical sector. Proactive steps taken by government and non-government organizations will enable the medical tourism market sail despite losses incurred during COVID-19.

Who is winning?

Medical tourism market is expanding at a fast rate. Tier 1 companies such as AsklepiosKlinikenGmbH, Bangkok DusitMedical Services, Fortis Healthcare Limited, Apollo Healthcare, BumrugrandInternational Hospitals, ChristusMughuerza, and others contribute nearly 6% to 17% of revenue generated by the market.

Tier 2 companies operating in the market include Asian Heart Institute, Prince Court Medical Center, ShouldiceHospital, Gleneagles Hospital, ClemenceuMedical Centre, AnadoluMedical Centre, and others. These companies account for the lion’s share of the global market.