The German National Tourist Board (GNTB), the EVVC European Association of Event Centres and the GCB German Convention Bureau announced key figures for the meetings, congresses and event market in Germany.

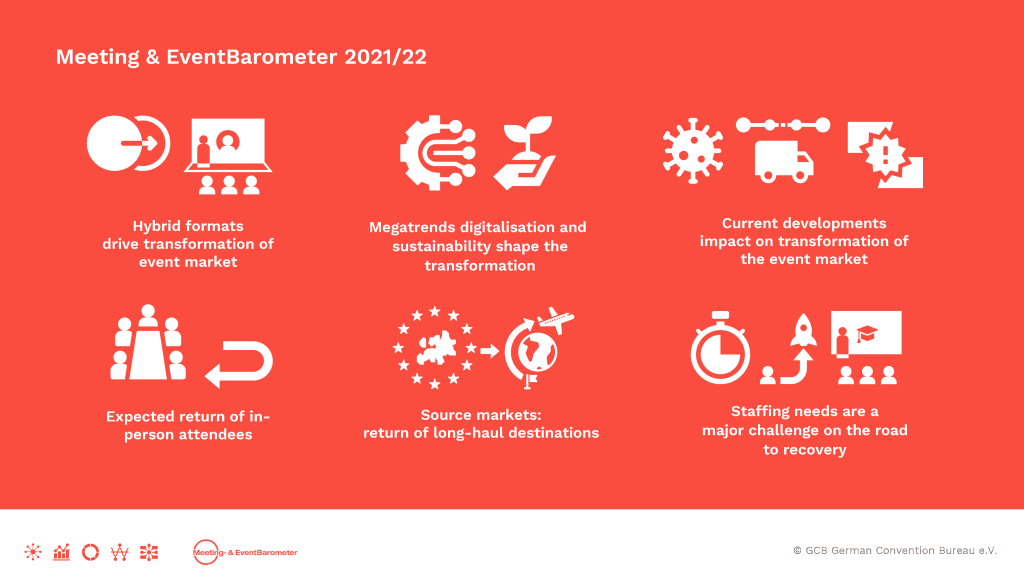

According to the results of the new “Meeting- & EventBarometer 2021/2022, hybrid and virtual formats, as well as sustainable event planning, are here to stay.

Hybrid events in particular are emerging as a future-proof driver for business events. Despite numerous challenges, in-person attendees are expected to come back at a high level within the next few years. The change that was driven by the Covid-19 pandemic has by now taken on a clear shape.

Trends in incoming business travel

After the huge slump in the first year of the pandemic, the total number of business travellers from Europe to Germany decreased by another 12% in 2021, according to analyses by IPK International. Nevertheless, Germany continued to lead the ranking of European business travel destinations by a wide margin. Of the 29.7 million business trips made by Europeans in 2021, 4.4 million were to Germany. France followed in second and third place with 2.4 million and Italy with 2.3 million. The segment of promotable business travel, which covers travel related to trade fairs and MICE, contributed 2.1 million trips to the German incoming business travel market. The volume of business travel from the USA stabilised in the second year of the pandemic at 300,000 business trips, of which 71% were MICE trips.

The forecasts for 2022 are positive. According to studies by IPK International, 23% of respondents worldwide are planning business trips abroad. In Asia (38%) and America (33%), the intent to go on business trips is significantly stronger than in Europe (14%). Compared to the worldwide travel intentions, among those interested in Germany, the demand for MICE travel with 79% clearly exceeds the segment of traditional business travel with 49%.

“As an internationally leading business travel destination, Germany is well prepared for the ‘new normal,’” says Petra Hedorfer, CEO of the German National Tourist Board.

“On the one hand, the market players have positioned themselves for the future demands of the market with innovative products: Hybrid formats combine the strengths of virtual events with the special atmosphere of personal encounters. At the same time, the impact of events can be extended by linking up in the digital space without increasing the CO2 footprint through constantly more travel, which is a valuable contribution to more sustainable business travel. On the other hand, we clearly see a pent-up demand and in the markets that were more affected by pandemic travel restrictions, travel intentions are increasing disproportionately. This confirms how important on-site attendance is in the mix of online, in-person and hybrid events. Given innovative offers, the need for resource-saving tourism and high demand, we see great opportunities to expand Germany’s top position as a business travel destination.”

The German event market

In the second year of the Covid-19 pandemic, clear prospects for the German event market emerge. The number of in-person attendees increased by 10.3% compared to the previous year. In addition to in-person events, this is mainly due to the strong increase in those who decide to attend hybrid events in person. Of the 68.4 million people who attended a business event on-site in 2021, 50 million attended an in-person event (2020: 60 million), and 18.4 million (2020: 1.8 million) attended a hybrid event. While the number of attendees at in-person events declined slightly due to the pandemic, hybrid formats, i.e. in-person events with the option of online participation, turned out to be market drivers. In 2021, a total of 4.2 million events (2020: 2.3 million) with 432 million attendees (2020: 232.5 million) took place in Germany across the three formats online, hybrid and in-person. The supply side, i.e. the number of venues, remained stable in the second year of the crisis. The emergence of new venues with adapted services, for example through the conversion of existing buildings, underpins the essentially positive outlook for the future.

Work-related travel is on the rise again compared to 2020, albeit with continued capacity adjustments and limited international travel. These restrictions are also reflected in the numbers of international attendees with an average share of 2% in 2021.

Digitalisation meets sustainability

The pandemic has strongly driven the digital transformation of the event market. Virtual formats have brought about structural change in the event market and at the same time also created a higher awareness for the importance of sustainable business events. 79% of the organisers surveyed stated that sustainability plays an important role for them and significantly influences their decision-making. Particular weight is given to how people travel to events. In view of the convergence of the megatrends of digitalisation and sustainability, hybrid events are becoming doubly important. In 2021, they achieved an outstanding growth of 280% with 0.36 million events organised. With 3 million events, the share of virtual formats also increased by 120%. With 0.8 million, the number of in-person events decreased slightly compared to the previous year. Nevertheless, the on-site attendees of hybrid events, together with the attendees at in-person events, form a growing group of people who want to meet in person.

Business events of the future are multidimensional

The figures illustrate the need for a dual focus on face-to-face encounters and linking up online, which is confirmed by both the surveyed organisers and suppliers with a view to how the market will develop in the coming years. The flexibility that attendees can enjoy as a result also noticeably increases the reach of events. “The different ways of attending events reflect an overarching trend: the future of business events is not one-dimensional but will play out in different scenarios,” says Matthias Schultze, GCB managing director.

“While some want the maximum flexibility provided by taking part in events remotely, others prefer to meet people in person in authentic surroundings. In future, these changing customer requirements will have to be considered with even more attention and corresponding offers will have to be developed. Germany as a destination for meetings and congresses is well prepared for such diverse demands with an equally diverse offering.”

Staffing needs as a major challenge on the road to recovery

Cancellations and postponements due to government-side Covid-19 measures, in particular a ban on events and capacity restrictions, continued to impact turnover in 2021: suppliers report around 62% less turnover than in 2019, but an increase of 0.7% compared to 2020. The outlook for the future is positive as event centres, conference hotels and event venues expect constant growth in the next few years, which in some cases would even exceed the pre-crisis level. The biggest challenge will be staff because a large number of businesses are looking for new employees across all qualification levels, but are currently having difficulties covering the demand.

“German event venues are still severely affected by the Covid-19 pandemic, but, with their innovative offerings, can look to the future with optimism,” says Ilona Jarabek, President of the EVVC.

“However, in order to be able to meet future demand in the same high quality and to attract the staff our industry needs, we have to develop new working hour models, promote young talent and provide relevant training. This is all the more true as a comprehensive range of services is one of the top deciding factors when choosing a venue.”

Continued transformation impacted by current developments

The results of the Meeting- & EventBarometer 2021/2022 show that sustainability and digitalisation are two basic requirements for the successful recovery of the German event market. Suppliers and organisers have recognised the benefits of online and hybrid formats as well as the desire for meaningful personal encounters in authentic surroundings and are adapting to the correspondingly changed needs in the market. Events with a high proportion of on-site attendees continue to be the core of a future-proof industry in transition.

In addition to megatrends such as digitalisation and sustainability, the transformation of the market is also affected by current developments. In a recent analysis commissioned by the GCB, Oxford Economics has presented three different forecasts, considering the development of the Covid-19 pandemic, the restrictions on international supply chains and the war in Ukraine. According to the medium “baseline” scenario, the analysts expect the market to largely recover by 2024 in terms of the number of event attendees.