Visa reports record surge in Japan ski tourism and visitor spending as the country’s winter destinations attract more international travelers than ever before.

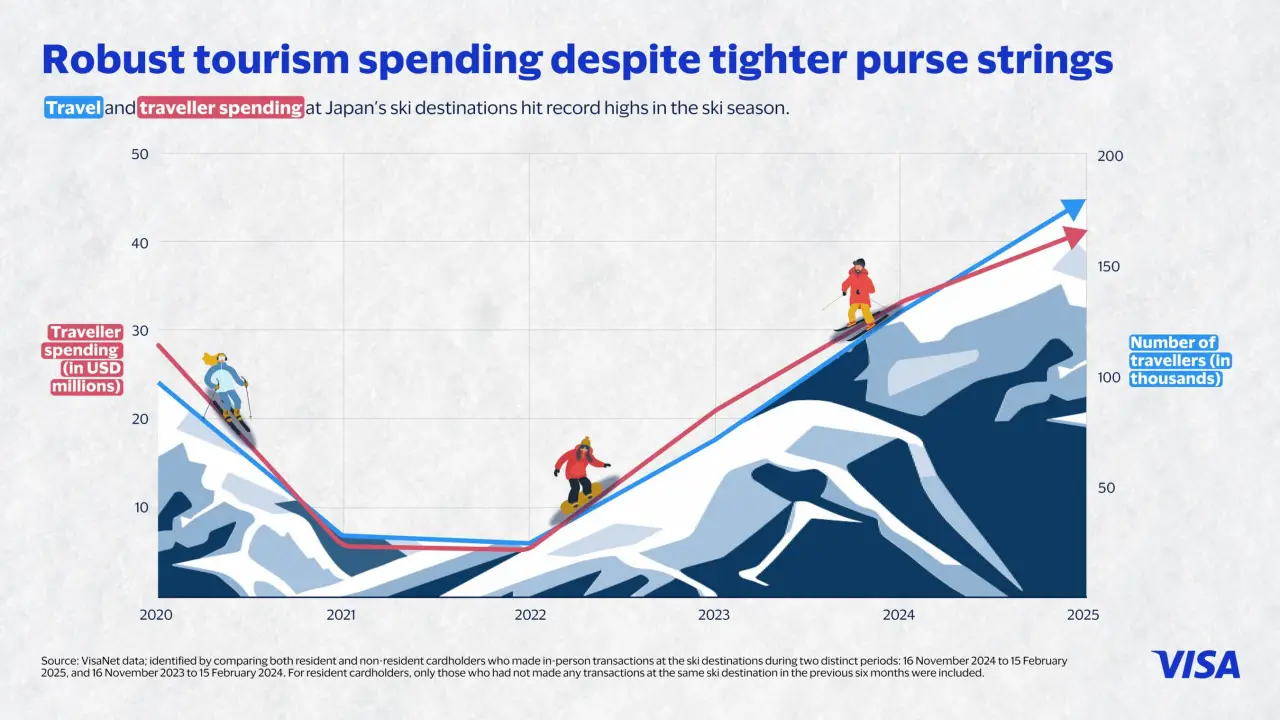

According to Visa’s latest analysis of spending data from November 2024 to February 2025, the number of ski travelers visiting Japan has not only rebounded from pre-pandemic levels but soared past them, setting a new benchmark for inbound winter tourism.

The data shows a 40% year-on-year increase in visitor numbers across Japan’s top ski destinations, including Niseko, Hakuba, and Furano. International tourists made up about 80% of all ski travelers and contributed around 90% of the total spending during the peak winter season. This unprecedented growth in both volume and expenditure highlights Japan’s emergence as one of the world’s most sought-after ski destinations.

Australia led the pack, accounting for approximately 30% of all international ski travelers to Japan. Visitors from the United States followed with around 20%, while travelers from Southeast Asian countries—particularly Singapore, Thailand, and Malaysia—made up roughly 12% combined. For travelers from Mainland China, Japan is now the preferred ski destination, and for Australians, it ranks just behind New Zealand.

Niseko and Hakuba continue to dominate among global visitors, attracting nearly half and about 35% of international ski travelers, respectively. Furano, traditionally popular with local skiers, is now rapidly gaining global attention. The resort posted a 70% increase in international visits compared to last year, making it one of the fastest-growing ski areas in Japan.

While domestic travelers tend to stay longer—averaging about five days—international visitors spend more than three times as much per day. Entertainment, lodging, and dining collectively accounted for 50% to 70% of overall spending across all visitor segments. Notably, spending directly related to the ski resort experience made up over 40% of expenditures among overseas tourists.

Visa’s findings also reveal that Japan’s appeal extends beyond its snow-covered slopes. Over 90% of international travelers extended their ski trips by an average of nine additional days, traveling to cities like Tokyo, Osaka, and Chiba. During this post-ski phase of their trip, visitors boosted the local economy with significant spending on retail—especially in department stores, discount shops, and grocery outlets—which accounted for about 40% of post-ski expenses. Dining made up roughly 20% of the additional spend.

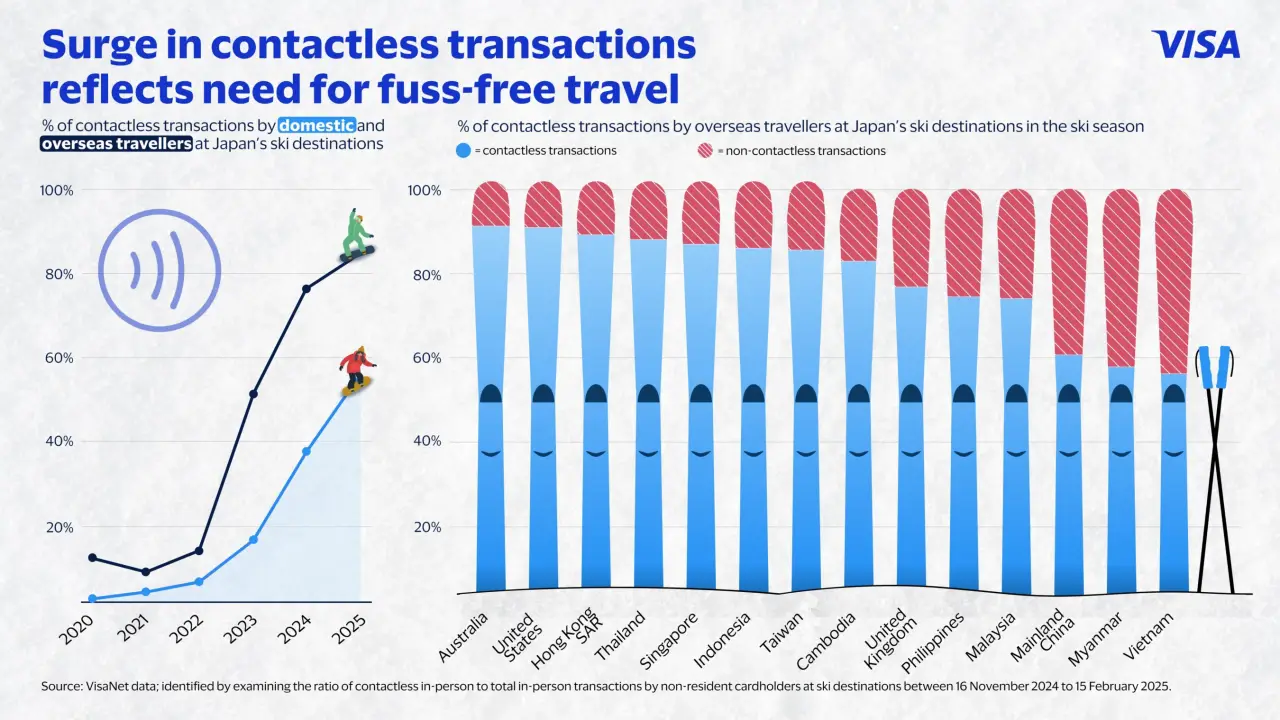

One of the most notable trends observed was the adoption of contactless payments. Over 80% of spending among international visitors was contactless, with nearly half of these transactions made through mobile payment platforms. This reflects a 30% increase from the previous year and underscores the growing role of digital payment technologies in the travel experience.

Prateek Sanghi, Head of Visa Consulting and Analytics for Asia Pacific, noted that the data reflects not only the rising popularity of Japan’s ski offerings but also provides valuable insights for businesses and governments. “By leveraging data-driven consumer insights, governments and especially local businesses can better optimise their offerings, enhance traveller experiences, and modernise payment methods for the varying visitor segments,” he said.

Visa’s report reinforces the strategic importance of tourism in driving regional economic growth. As global travel patterns shift, Japan’s ability to attract high-spending, experience-driven travelers positions it well for long-term success in the winter tourism sector. The combination of natural beauty, modern infrastructure, and seamless digital payment options makes it an increasingly attractive choice for international tourists seeking more than just snow.

With winter now giving way to spring blossoms, Japan’s ski towns are closing their most successful season yet. The record-breaking numbers are not only a testament to the country’s appeal but also a sign of how data and innovation are helping to shape the future of global travel.