Despite prevailing economic uncertainties, the latest research suggests that consumers are eager to splurge on travel in the coming year.

The report titled ‘Consumer travel spend priorities’ by Outpayce, an Amadeus subsidiary, has returned for its second edition, underlining an enthusiastic consumer sentiment towards international travel.

When consumers were presented with six discretionary spending categories, international travel emerged as the top choice.

Even more encouraging for the travel industry is the noticeable year-over-year growth, with 47% of respondents marking travel as a ‘high priority’ for the upcoming year, reflecting a substantial 12% uptick from the previous year. Furthermore, participants anticipate dedicating an average of $3,422 on international escapades, marking a 28% surge or an additional $753 per consumer compared to the previous year.

Jean-Christophe Lacour, SVP Global Head of Products Management and Delivery at Outpayce, provided insight into the findings: “Consumers’ appetite for travel remains robust, with many willing to allocate funds that were saved during the pandemic towards international journeys. However, travel enterprises must remain alert. Success hinges on transparent pricing in native currencies, offering flexible payment methods, and ensuring a hassle-free retail experience.”

Payment Preferences

The research also delved into payment preferences. Last year’s data highlighted a massive 75% inclination towards the Buy Now Pay Later (BNPL) model for travel expenses. The recent findings show a dip, with only 33% of travelers leaning towards BNPL for future travel, signaling a moderation in its growth rate. The use of short-term credit tools like credit cards or payday loans has also witnessed a decline this year. A noteworthy 40% of participants expressed intentions to channel their savings towards travel, while another third envision redirecting funds from areas like clothing and home improvement.

Travelers value fintech that provides transparency and limits fees

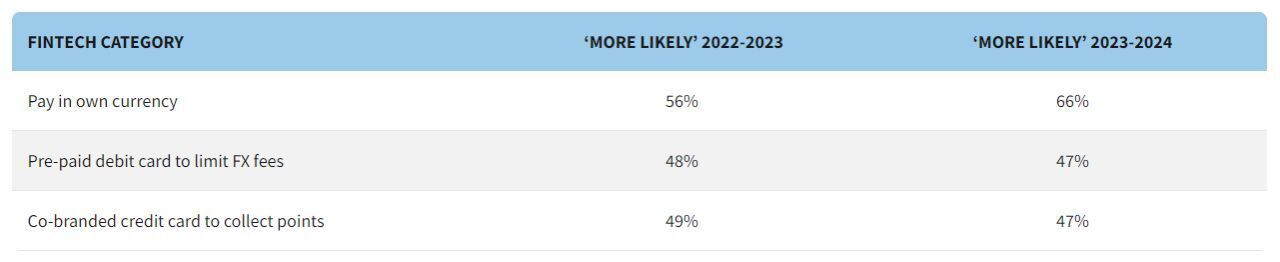

Another central theme that emerged is the value travelers place on fintech transparency, especially regarding foreign exchange fees.

A significant 66% indicated they would prefer travel companies offering payment options in their currency to comprehend travel costs better, marking an 18% rise from last year. Furthermore, 68% of respondents conveyed their intent to monitor FX fees closely during their travels.