Global market research company Euromonitor International has released the Top Five Digital Consumer Trends in 2024 report.

The annual report reveals emerging trends that provide insights into digital consumers’ evolving values and explores how their behaviour is redefining their shopping motivations and needs. It also examines the technological advances in the year ahead that will continue to reshape consumer behaviour.

Euromonitor’s Top Five Digital Consumer Trends in 2024 are:

- Intuitive E-Commerce: The rising influence of digital channels among consumers is putting pressure on companies to improve the online experience. This is possible due to evolving data-gathering strategies and emerging technologies, from AR to IoT to Gen AI. These advances have the potential to transform the online shopping experience, leading to one that is more intuitive.

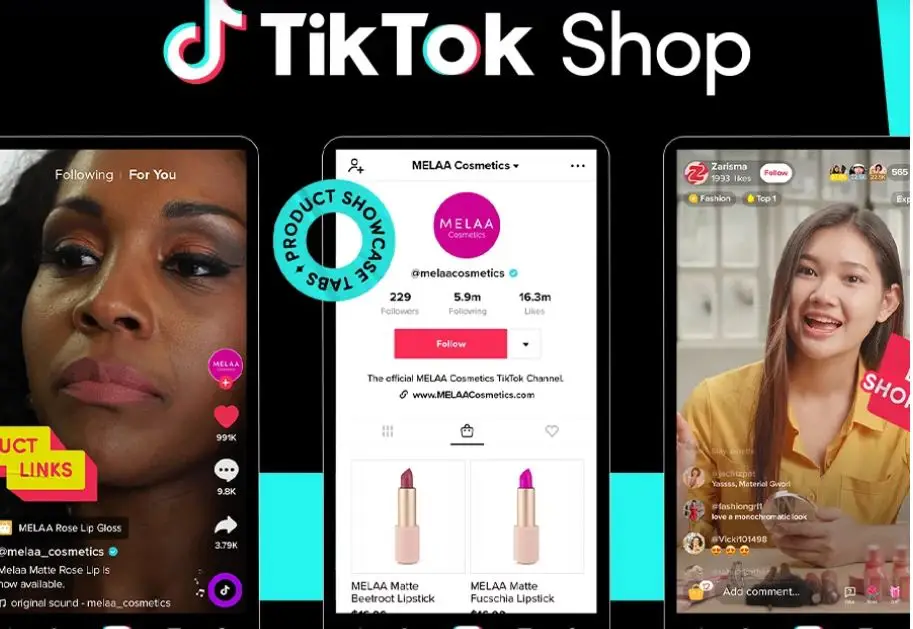

- TikTok Economy: Digital consumers are flocking to TikTok and Douyin, twin social media platforms that have embraced short-form video content. As the user bases of TikTok and Douyin continue to expand, these platforms will become even more important to brands’ digital marketing strategies. Although brand-led social media campaigns can be effective, the most successful marketing strategies will be those that can effectively harness the power of authentic, organically created viral trends.

TikTok Shop was launched in the US in September 2023 and it brings shoppable videos and LIVE streams directly to For You feeds across the US – and give brands, merchants, and creators the tools to sell directly through shoppable content on the TikTok app.

According to research conducted by Oxford Economics, U.S. small- and mid-sized businesses (SMBs) that marketed or advertised on TikTok generated nearly $15 billion in revenue in 2023. The study also found that nearly 40 percent of SMBs say TikTok is critical to their existence, which is home to seven million businesses and 170 million active users in the U.S.

Oxford Economics in another report also found that small businesses on TikTok contributed an additional €4.8 billion to the economies of Germany, France, Italy, Netherlands and Belgium in 2023.

- Outsmart Online: Against a backdrop of mounting macroeconomic uncertainty and increasing digitalisation, consumers are seeking out online platforms dedicated to rooting out the best deals. Brands must navigate the new digital landscape in ways that do not alienate their customers. While leaning into viral hacks may sometimes be a good option, the best strategy for brands is to offer consistent, clear messages regarding the value provided by their goods.

- Recommerce 2.0: Recommerce is surging and evolving globally, driven by environmentally conscious, thrifty and tech-savvy younger consumers. As consumers become increasingly climate-conscious and mindful of their spending, recommerce will continue expanding into new categories and adding more value-driven services. More companies will realise the potential of recommerce for sustainability and new revenues, driving increased innovation and investment in the field.

- Revamped Returns: Consumers have long wanted hassle-free returns, but delivering on that expectation has not been without challenges. Retailers looking for long-term success will need to take a holistic view of the customer experience from discovery to purchase to return. Converging trends like the rise of e-commerce, store closures and more sustainable strategies is moving returns up the agenda. New technologies and partnerships are paving the way to a happier return experience for shoppers. Most importantly, they will not punish customers who may still need to return products.

Michelle Evans, Global Lead of Retail and Digital Insights at Euromonitor International, said: “Cautious and conscious consumption is growing. The cost of a purchase whether that cost is monetary or environmental was top of mind for digital consumers in 2023 and will continue to be in 2024. Saving money is playing out in how consumers are seeking to outsmart brands online or joining the resale movement.

“Consumers are also seeking more power in their relationships with brands. This is prevalent in both the TikTok Economy and Outsmart Online trends, which at their roots are about how consumers are using social media to give them a greater voice in the consumer-brand relationship. The benefit of hearing from consumers over the brands is that it leads to more authentic interactions, which is valued by younger consumers like Gen Z.

“With twice as many digital consumers in the world as compared with a decade ago and the spend for goods and services online more than doubling in that timeframe, it is important to prepare strategies with these digitally savvy shoppers in mind,” said Evans.